The North American market for collector minerals, healing crystals, and semi-precious stones is growing at an astonishing rate. What was once a niche interest among New Age enthusiasts has now become a mainstream, multi-billion-dollar industry, fueled by social media trends, wellness movements, and a renewed appreciation for natural beauty.

If you’ve ever considered starting a crystal business—whether online, in a retail shop, or even through social media sales—now is the time. Demand for ethically sourced, high-quality stones is rising, and consumers are looking for trusted sellers who can provide not just beautiful crystals, but also knowledge and authenticity.

But with opportunity comes competition. Selling crystals today requires more than just stocking up on inventory—you need to understand emerging trends, sourcing strategies, and evolving customer expectations. Should you sell on Etsy or build your own brand? How do you navigate the growing demand for ethically sourced stones? Which crystals are trending, and how can you differentiate yourself in the market?

In this guide, we dive deep into the state of the crystal industry in 2025 and beyond—covering market trends, top sales channels, and actionable strategies to help you thrive. Whether you’re a new entrepreneur exploring the space or a seasoned seller looking to stay ahead of the curve, this is your playbook for success in one of the most exciting retail markets today.

Table of Contents:

North American Market for Collector Minerals, Healing Crystals & Semi-Precious Stones

Major Industry Players (B2C & B2B)

Alignment with Broader Retail Trends

Actionable Takeaways for Crystal Retailers

North American Market for Collector Minerals, Healing Crystals & Semi-Precious Stones

(Excluding industrial minerals and precious gemstones)

Market Size & Growth Trends

The North American market for collector minerals and healing crystals has seen robust growth in recent years. In the United States alone, the healing crystal industry was valued around $1.2 billion in 2020 and is projected to reach $1.8 billion by 2024, reflecting an approximately 8% CAGR (Healing Crystal Industry Forecast for 2024 in the USA - Wishcrystal.com) (Healing Crystal Industry Forecast for 2024 in the USA - Wishcrystal.com). This growth is driven by increasing consumer interest in holistic wellness and spiritual practices. Canada’s market follows similar trends (albeit smaller in size), contributing to a combined North American market value likely in the low single-digit billions. Globally, spiritual and wellness products (a category that includes crystals) were estimated at $4.2 billion in 2023 with an 8.0% CAGR expected through 2034 (Spiritual and Wellness Products Market Poised to Reach US$), indicating sustained worldwide momentum. The COVID-19 pandemic further boosted demand as consumers turned to self-care and alternative healing; the crisis “heightened focus on personal well-being, leading people to seek out therapies such as crystal healing” (Healing Crystal Industry Forecast for 2024 in the USA - Wishcrystal.com). Even as the pandemic subsides, the habit of using crystals for wellness is expected to continue growing.

Key Trends Driving Demand

Several social, cultural, and economic factors are powering the rise of crystals and semi-precious stones in North America:

- Mainstream Wellness & Spirituality: What was once niche “New Age” is now mainstream. Approximately 42% of Americans believe that spiritual energy can reside in physical objects like crystals (Why Crystals And Gemstones Are Taking The Center Stage In Jewelry And Accessories), indicating broad acceptance. Millennials and Gen Z, in particular, are open to holistic wellness, meditation, and manifesting practices – all of which often incorporate crystals (Healing Crystal Industry Forecast for 2024 in the USA - Wishcrystal.com) (Healing Crystal Industry Forecast for 2024 in the USA - Wishcrystal.com). This cultural shift toward mindfulness and mental health has normalized using crystals for stress relief, love, confidence, etc. High-profile celebrities (from pop icons to influencers) tout their benefits, further bringing crystals into the spotlight. For example, singer Adele famously used crystals to overcome stage fright, which helped “calm her nerves” during tours (Simon Cowell's surrounded by them & Adele swears they help stage ...).

-

Social Media Influence: Online platforms have been instrumental in popularizing crystals. On TikTok, the hashtag #Crystals amassed over 6.6 billion views as of late 2021 (Healing crystals work (if you choose to believe in them) – The Wildcat Tribune), as young users share crystal hauls, rituals, and collections. Instagram and YouTube likewise host thriving crystal communities, and viral trends have driven demand for specific stones (e.g. moldavite went viral on TikTok, causing shortages in 2020–21). Crystals’ visual appeal makes them “Instagrammable” – from dazzling amethyst geodes to colorful crystal grids – which encourages sharing and aspirational purchasing. Influencers and spiritual coaches often showcase their favorite stones or routines, directly impacting sales. The social media buzz not only educates consumers (e.g. posts explaining crystal properties) but also creates fomo for rare or trending minerals.

-

Tech and Personalization: A fusion of ancient practice with modern tech is emerging. Wellness apps and digital platforms now offer personalized crystal recommendations (based on astrological charts or energy assessments) and guided rituals (Forecast for Healing Crystal industry in 2025 - Wishcrystal.com). Some innovators are even integrating crystals into wearable technology for mindfulness or biofeedback (Forecast for Healing Crystal industry in 2025 - Wishcrystal.com). This tech embrace aligns with broader retail trends of personalization – for example, subscription services curate monthly crystal boxes tailored to an individual’s intentions or zodiac. One popular service, The Crystal Council’s monthly box, lets users specify goals (like “anxiety relief” or “inner peace”) and has already delivered 100,000+ customized crystal boxes to subscribers (Monthly Crystal Subscription Box | The Crystal Council - The Crystal Council ) (Monthly Crystal Subscription Box | The Crystal Council - The Crystal Council ). This trend toward customization and convenience (leveraging data and e-commerce) is attracting a tech-savvy audience.

-

Sustainability & Ethical Sourcing: As demand soars, consumers are increasingly concerned about where crystals come from. Buyers in the U.S. and Canada (as well as Europe) are “scrutinizing the origins of their crystals, favoring ethically sourced and environmentally sustainable options” (Forecast for Healing Crystal industry in 2025 - Wishcrystal.com). There is growing awareness that many semi-precious stones are mined in developing countries with poor labor and environmental standards. Media investigations have highlighted the “brutal reality” behind the crystal boom – “demand for 'healing' crystals is soaring – but many are mined in deadly conditions in some of the world's poorest countries” (Dark crystals: the brutal reality behind a booming wellness craze). In Madagascar, for instance, rose quartz and other minerals are often extracted by hand in hazardous mines. This knowledge is pushing consumers (and retailers) to seek suppliers who practice fair trade, offer transparency, or give back to mining communities. Brands that adopt ethical sourcing and eco-friendly practices are likely to dominate forward-thinking markets (Forecast for Healing Crystal industry in 2025 - Wishcrystal.com) (Forecast for Healing Crystal industry in 2025 - Wishcrystal.com). Additionally, sustainability-minded customers appreciate initiatives like biodegradable packaging, carbon-neutral shipping, and avoiding harmful chemical treatments on stones.

-

Integration into Lifestyle & Decor: Beyond metaphysical healing, crystals have become coveted as home décor and fashion accessories. Interior designers incorporate large geodes or crystal clusters as statement pieces in homes and hotels. There’s a notable “blend of aesthetics and functionality” – e.g. selenite lamps that serve as ambient lighting and energy cleansers, or crystal bookends and coasters that double as decor (Forecast for Healing Crystal industry in 2025 - Wishcrystal.com) (Forecast for Healing Crystal industry in 2025 - Wishcrystal.com). The rise of spiritual jewelry is part of this trend: many consumers wear crystal pendants, bracelets, or malas not only for style but as daily wellness reminders. This overlaps with the booming spiritual jewelry market (valued at $3.2B globally in 2023) and its expected 10% annual growth (Spiritual Jewelry Market Size, Trends, Growth, & Forecast) (Spiritual Jewelry Market Size, Trends, Growth, & Forecast), driven largely by younger buyers seeking meaning in accessories. The fashion world has also embraced semi-precious stones – for example, increasing use of colored gems like amethyst, moonstone, or quartz in engagement rings and jewelry as alternatives to traditional diamonds (Why Crystals And Gemstones Are Taking The Center Stage In Jewelry And Accessories) (Why Crystals And Gemstones Are Taking The Center Stage In Jewelry And Accessories). Overall, crystals are now seen as lifestyle products that enhance one’s space and personal style, not just as esoteric healing tools.

-

Wellness Services & Experiences: Hand-in-hand with product sales, experiential use of crystals is on the rise. Yoga studios, meditation centers, and spas incorporate crystals into their services – from sound baths with crystal bowls to Reiki healing sessions that place stones on clients’ chakras (Forecast for Healing Crystal industry in 2025 - Wishcrystal.com) (Forecast for Healing Crystal industry in 2025 - Wishcrystal.com). Such offerings have become popular in wellness tourism and retreats. Additionally, education and community-building around crystals have grown. Retailers and enthusiasts host workshops (online and in-person) on crystal healing, and some practitioners offer certification courses. In North America, interest in learning is high – there’s a “desire for knowledge” that manifests in local classes, Zoom webinars, and bustling Facebook groups for crystal lovers (Forecast for Healing Crystal industry in 2025 - Wishcrystal.com) (Forecast for Healing Crystal industry in 2025 - Wishcrystal.com). These experiences not only drive sales (participants often buy stones after learning about them) but also deepen customer engagement with the hobby.

Major Industry Players (B2C & B2B)

The crystal and mineral retail industry in North America is highly fragmented, with thousands of small sellers, but a few key players and formats stand out:

-

Specialized Retailers (B2C): Many successful crystal retailers have built devoted followings through branding, curation, and education. For example, House of Intuition, an LA-based metaphysical chain (BIPOC-owned, founded 2010), has multiple storefronts and an online shop. They differentiate by sourcing “the highest quality crystals” globally (from Brazil, Africa, Russia, Dominican Republic, etc.) to offer hundreds of varieties (10 Best Online Shops For Healing Crystals - The Good Trade), and by fostering a spiritual community (they host tarot readings and classes in-store). Another leader, Sage Goddess, exemplifies scale in this niche – it has processed over 150,000 orders to date, making it a trusted source for crystals, and it augments product sales with online courses and content on crystal lore (10 Best Online Shops For Healing Crystals - The Good Trade). Founder Athena Perrakis blends formal training in psychology with shamanic healing, and leads a team of 27 practitioners, giving the brand authority and a broad service offering (10 Best Online Shops For Healing Crystals - The Good Trade). Sage Goddess also implements a give-back program (donating part of proceeds) and maintains a presence on Etsy in addition to its own site (10 Best Online Shops For Healing Crystals - The Good Trade) (10 Best Online Shops For Healing Crystals - The Good Trade) – a sign of omnichannel strategy. Other notable U.S. retail brands include Energy Muse (focused on crystal jewelry and co-authored a best-selling book on crystal healing), The Crystal Council (known for its subscription boxes and personalized approach), Moonrise Crystals (emphasizing ethical sourcing and detailed provenance for each stone), and Kalifano (Las Vegas-based, specializing in large statement geodes, fossils, and decor pieces). These businesses thrive by curating high-quality inventories, sharing rich information about the stones, and often by branding crystals as part of a broader lifestyle (self-love, empowerment, etc.).

-

Marketplaces & E-Commerce Platforms: It’s impossible to ignore the role of Amazon and Etsy in crystal retail. These platforms host countless independent sellers of minerals and metaphysical supplies. Amazon offers sheer convenience and reach – consumers can find crystal kits, bulk stones, and even high-end mineral specimens with Prime shipping. However, quality varies greatly, and issues with fakes or mislabeled stones (e.g. dyed glass sold as quartz) are known challenges, pushing knowledgeable buyers to more curated shops. Etsy, on the other hand, has become a go-to marketplace for artisan crystal sellers and lapidary experts. Etsy’s user base often seeks handmade or one-of-a-kind items like wire-wrapped crystal jewelry, raw mineral decor, or personalized sets. As of 2022, Etsy even highlighted “crystals” among key Fall trend materials (Marketplace Insights: 2022 Fall Trends - Etsy) (Marketplace Insights: 2022 Fall Trends - Etsy), indicating strong sales in that category. Both Amazon and Etsy have enabled micro-entrepreneurs across North America to tap into the crystal craze, collectively accounting for a significant share of B2C volume. Additionally, newer social selling platforms (like Facebook Marketplace, Instagram Shop features, and even TikTok Shop) are emerging channels for one-off sales and small vendors.

-

Wholesale Distributors & Importers (B2B): On the business-to-business side, large importers and wholesalers form the backbone of supply. These companies source minerals in bulk from mines and cutting factories around the world (Brazil, China, India, Madagascar, Morocco, etc.) and supply retail shops, market vendors, and e-commerce sellers across North America. One prominent example is WishCrystal (headquartered in California with manufacturing in India), which markets itself as a “one-stop wholesale” provider. WishCrystal boasts that it supplies over 3,000 retail shop owners, distributors, and importers across North America with crystals and jewelry (Crystal Wholesaler and Manufacturer of Metaphysical Crystals in United States & Canada.) (Crystal Wholesaler and Manufacturer of Metaphysical Crystals in United States & Canada.). By owning a manufacturing unit overseas and cutting out middlemen, they offer competitive prices and a huge catalog – from tumbled stones and points to orgonite pyramids and chakra sets (Crystal Wholesaler and Manufacturer of Metaphysical Crystals in United States & Canada.) (Crystal Wholesaler and Manufacturer of Metaphysical Crystals in United States & Canada.). In Canada, a similar role is played by companies like Stonebridge Imports (based in Ontario), which import large volumes of amethyst, quartz, and gemstone products and redistribute to Canadian metaphysical stores – allowing those retailers to avoid complex import logistics and duties. Other major wholesalers include From the Mines (a New Jersey-based importer emphasizing ethical sourcing), Crystal River Gems (Pennsylvania-based, 25+ years in business, with a showroom and direct import model (Gemstone Jewelry, Rock Shop, Crystals, Agate | Crystal River Gems )), and numerous suppliers clustered around trading hubs like the Tucson gem shows or Los Angeles’ jewelry district. These B2B players differentiate themselves through the breadth of inventory, reliability, and often by specializing (for instance, some focus on high-end collector mineral specimens for museums and serious collectors, while others focus on affordable metaphysical grades).

-

Mining Sources & International Suppliers: Although much of the North American market relies on imports, there are notable local sources and global mining companies influencing supply. In the U.S., Arkansas is famous for its quartz mines (e.g. Ron Coleman Mining offers tourist digging as well as wholesale buckets of quartz), and Upstate New York is known for Herkimer “diamonds” (quartz crystals) mined by a few established mines. These domestic sources have niche importance for specific crystal types. Internationally, large mining/export firms in Brazil (for amethyst, citrine, clear quartz), in Madagascar (for labradorite, celestite, rose quartz), and in China (for mass-market tumbled stones and carvings) supply the bulk of raw material. Often, raw stones pass through cutting and finishing centers in India or China where they are turned into the polished shapes popular in retail (points, spheres, palm stones, etc.). This global supply chain means wholesalers with direct connections to miners (or who travel to source in person) can offer better prices or exclusive items. For example, House of Intuition mentioned working directly with vendors from Africa to Russia to hand-pick quality stock (10 Best Online Shops For Healing Crystals - The Good Trade). Overall, while no single company dominates the way a big box retailer would in other industries, those who have optimized their supply chain (vertical integration, ethical sourcing, or bulk buying power) have a competitive edge.

Why They Dominate & Differentiate: The leading players – whether consumer-facing brands or wholesale suppliers – succeed by differentiating on trust, quality, and ethos. Many highlight authenticity (guaranteeing genuine natural stones amid a market that has synthetics and fakes) and provide educational content to build credibility. Others carve out a niche: some focus on affordability and breadth (appealing to new enthusiasts with low-cost starter crystals), while others focus on high-end collectors willing to pay thousands for rare minerals. Brand story and community also play a role; for instance, Sage Goddess’s blend of spirituality and coaching attracts a loyal following that sees the brand as more than a shop – it’s a source of learning and fellowship. Businesses owned by practitioners (shamans, healers, gemologists) often leverage that expertise in their marketing, distinguishing themselves from mass-market sellers. Additionally, ethical positioning is becoming a key differentiator: companies that can prove fair labor, donate to mining communities, or at least transparently share the origins of their stones, earn trust from the growing segment of conscious consumers. Lastly, many successful players have embraced omnichannel strategies – selling through their own website, social media, and third-party marketplaces, and sometimes maintaining a physical showroom or presence at events. This multi-channel approach ensures they “meet customers where they are,” which is crucial in a niche where discovery can happen on Instagram, but the purchase might happen on Etsy or at a local fair.

Sales Channels & Distribution

Crystals today are sold through a wide variety of channels, reflecting both traditional retail and innovative new methods. Key sales channels include:

-

E-Commerce Websites: Dedicated online crystal shops and direct-to-consumer brands have proliferated. These sites often provide detailed listings with photos of the exact stone you’ll receive (important since each crystal is unique). Brands like Sage Goddess, Energy Muse, or TheCrystalCouncil.com operate sophisticated web stores with filtering by stone type, intention, or chakra. The convenience and broad selection online have made e-commerce a dominant channel for purchasing crystals (Healing Crystal Industry Forecast for 2024 in the USA - Wishcrystal.com). Consumers can shop from anywhere and access inventory beyond what local shops carry. Many retailers report that a significant share (if not majority) of their revenue now comes from online orders, especially after pandemic lockdowns pushed metaphysical stores to beef up their web presence. Also, educational content (blogs, YouTube videos, etc.) linked to these web shops helps attract buyers searching for information.

-

Online Marketplaces: As mentioned, Amazon and Etsy are major avenues. Amazon tends to cater to commodity sales – e.g. bulk packs of tumbled stones, beginner crystal sets, healing stone kits with a mix of popular minerals, or home décor pieces like amethyst bookends. Reviews and Prime shipping influence purchase decisions here. Etsy, by contrast, is a haven for specialized sellers: a search for “healing crystals” on Etsy yields thousands of handmade items, vintage mineral specimens, and even intuitively curated “mystery boxes.” The marketplace model allows small businesses to reach a global audience. However, one challenge on such marketplaces is price competition and fee impacts: increased fees on platforms often force sellers to raise prices, and popular products can get copied by mass producers ( 5 Best Places to Buy Wholesale Crystals In Bulk ) ( 5 Best Places to Buy Wholesale Crystals In Bulk ). Despite that, these marketplaces remain vital, especially for new entrants who gain exposure from the built-in user base.

-

Brick-and-Mortar Stores: Physical retail is still very important for crystals. Metaphysical bookstores and New Age shops are classic outlets – these cozy stores sell crystals alongside incense, tarot cards, and spiritual books. Customers value the ability to see and touch the stones in person, feeling their energy or examining quality. In many towns, the metaphysical shop is a community hub for spiritually inclined individuals. Rock and mineral shops (sometimes attached to museums or tourist sites) are another category – for example, museum gift shops often carry sparkling mineral specimens and geodes as educational souvenirs. In tourist-rich areas (Sedona, AZ; Mount Shasta, CA; Banff, AB, etc.), crystal shops cater to visitors seeking a piece of local energy. There are also national retail chains that have dipped into this market: e.g. Earthbound Trading Co., a mall chain, offers a selection of tumbled stones and mineral decor in its stores across the US. Even mainstream home décor retailers have picked up the trend – one could find agate slice coasters, amethyst lamp finials, or rose quartz bookends at stores like HomeGoods or Anthropologie in recent years. While these aren’t pitched for healing, it shows crystals’ entry into general retail as decorative luxury objects. Notably, some brands straddle both online and offline; House of Intuition, for instance, operates multiple physical locations in California plus an online shop, exemplifying an omnichannel model that leverages experiential retail (psychic readings, classes in-store) to complement e-commerce.

-

Live Sales on Social Media: A modern phenomenon in crystal retail is the rise of live-stream selling. On Instagram and Facebook, numerous sellers run live video streams where they showcase crystals one by one (often using a table display and calling each item by lot number). Viewers claim pieces in the comments in real-time. These live sales create a sense of urgency and excitement (almost like a auction hybrid, though typically first-come-first-serve). According to industry sources, “many suppliers sell live daily on Instagram” allowing customers to purchase via live-stream video ( 5 Best Places to Buy Wholesale Crystals In Bulk ). Sellers often build a personal connection with their audience during lives, sharing properties of each stone, telling stories, and interacting with comments – it’s a form of entertainment-shopping. Facebook groups also host live crystal sales and “runnings” (where multiple sellers take turns streaming to the group’s audience). This channel accelerated during the pandemic and remains popular, as it simulates the treasure-hunt experience of a gem show from the comfort of home. That said, buyers have to trust the seller’s honesty (since colors or sizes on video can differ in person), and there’s some risk if dealing with an unknown seller. The community has responded by gravitating towards known sellers with large followings or requiring references, to reduce fraud risk ( 5 Best Places to Buy Wholesale Crystals In Bulk ) ( 5 Best Places to Buy Wholesale Crystals In Bulk ).

-

Subscription Boxes & Memberships: Subscription commerce has found its way into crystals. Several companies offer monthly crystal boxes where subscribers receive a curated selection of stones, often themed (e.g. a box for “grounding” might include hematite, smoky quartz, etc.). These boxes add an element of surprise and learning – inserts explain the stones’ meanings and how to use them. We’ve mentioned The Crystal Council’s customized box as a leader in this space. There’s also Enchanted Crystal (which sends a mix of raw specimens and tumbled stones monthly) and other niche players. Cratejoy, a subscription marketplace, lists dozens of “crystal and gemstone” subscription options (Healing Crystal Subscription Boxes: Gem & Rock Collections) (The Best Crystal Subscription Boxes in 2025 | MSA). This channel appeals to enthusiasts who want to steadily grow their collection and knowledge. For retailers, it provides recurring revenue and a way to move inventory consistently. Some crystal subscription services have built large communities, where subscribers share unboxing experiences on social media, effectively creating grassroots marketing for the service.

-

Trade Shows and Gem Fairs: Traditional gem and mineral shows remain crucial, especially for B2B transactions and serious collectors. The Tucson Gem & Mineral Showcase in Arizona every February is the world’s largest and most famous event – it “draws thousands from across the world” each year (First-Timer's Guide to the World's Largest Gem Show | Visit Arizona). Over 40+ shows happen citywide concurrently, where hotel rooms and giant tents turn into marketplaces for everything from $1 tumbled stones to museum-grade emeralds (First-Timer's Guide to the World's Largest Gem Show | Visit Arizona). “Every hotel…turns into a pop-up shop selling everything from crystals and African crafts to jewelry… from Asia, Europe, Latin America, India and the U.S.” (First-Timer's Guide to the World's Largest Gem Show | Visit Arizona). It’s both a wholesale buying bonanza (retailers come to stock up directly from miners/exporters) and a retail event (the public buys too, especially in the later days of each show). Other significant shows include the Denver Gem & Mineral Show, Tucson’s September show series, and regional events held by mineral societies. These shows are vital for discovering new sources, spotting trends (e.g. suddenly everyone has a new find of, say, Pink Amethyst from Argentina), and networking in the industry. They also allow small international miners to sell direct – e.g., a family mining labradorite in Madagascar might come set up a booth, connecting with North American buyers without a middleman. Trade shows thus act as a distribution channel funnel – much of the inventory that later ends up on shelves or online in North America first changes hands at these events. For instance, a crystal shop in Toronto might source a year’s supply by attending Tucson and striking deals with Brazilian and African vendors. Outside of major shows, local metaphysical fairs and expos also serve as sales channels: these are like mini-conventions where vendors sell crystals, jewelry, and holistic products, and patrons might also attend workshops or lectures. They cater directly to the consumer who enjoys the in-person experience but aren’t as large as the dedicated gem shows.

-

Influencers and Direct Sales: Some of the sales occur through influencer-driven channels. A number of social media influencers in the spiritual/wellness space have launched their own crystal lines or collaborate with retailers. For example, popular Instagram spiritual teachers might curate a collection of their “favorite crystals for inner peace” in partnership with a store, driving their followers to purchase. In other cases, small businesses themselves become influencers – e.g. the owner posts educational videos or aesthetically pleasing crystal grids, amassing followers, who then buy from their shop link. Additionally, community events like crystal auctions on Facebook groups (bidding style sales) or even Patreon communities where a monthly membership grants access to exclusive sales are part of the landscape. While relatively small-scale, these innovative direct-to-fan approaches exemplify how aligned this market is with broader creator economy trends in retail.

Across all these channels, a theme is that omnichannel presence is increasing. It’s not uncommon for a single crystal retailer to sell in-store, on their own website, on Etsy, do weekly Instagram Lives, and attend a few trade shows annually. Each channel serves a segment of their audience, and together they create a resilient sales network.

Alignment with Broader Retail Trends

The collector crystal industry both mirrors and contrasts mainstream retail movements in several ways:

-

Omnichannel & Digital Integration: Similar to broader retail, crystal sellers are adopting omnichannel strategies. Successful brands maintain a seamless presence online and offline – a customer might discover a shop on Instagram, browse its Etsy listings, and then visit its physical booth at a fair. This aligns with mainstream retailers using an integrated online/offline approach. Even smaller crystal shops now utilize inventory management and point-of-sale systems that sync with their website stock, so they can sell in-store and online without conflicts. Additionally, the use of tech in marketing – such as search engine optimization for metaphysical keywords, email newsletters, and even augmented reality (imagine viewing a 3D model of a crystal on your phone) – is growing. In this way, crystal retail is catching up to digital best practices seen in other sectors. However, some contrasts remain: many tiny crystal sellers are one-person operations who might not have sophisticated e-commerce setups, relying instead on social media DMs or PayPal invoices, which is a more grassroots approach than a typical retailer with a full Shopify site. Over time, as the industry matures, more consolidation and professionalization (e.g. dedicated online storefronts, fulfillment centers, etc.) may occur to match mainstream retail operations.

-

Experiential and Community-Oriented Shopping: Crystal retail is inherently experiential – touching a smooth stone or marveling at a giant amethyst cathedrals is a sensory experience. Mainstream retail has trended toward experiential shopping (e.g. stores with interactive displays, workshops, etc.), and crystal shops have been doing this naturally for years. Metaphysical stores often double as community centers, offering meditation circles, Reiki healing sessions, sound baths, or tarot readings in-store. This creates a unique experience that can’t be replicated online, giving people a reason to visit in person. It parallels how some mainstream bookstores host author events or cooking stores host classes to draw customers. Additionally, the sense of community – shoppers meeting like-minded people at a workshop or sharing stories about their crystals – builds loyalty and is a differentiator versus buying anonymously on Amazon. This focus on building a tribe around the brand or store is very much in line with modern retail’s emphasis on customer engagement and retention through experiences. It’s not unusual for crystal businesses to have thriving online communities as well, such as private Facebook groups for customers, where members discuss their new finds or post altar photos. This community-building mirrors what many lifestyle brands do to increase customer lifetime value.

-

Sustainability & Ethical Consumption: In mainstream retail, consumers are increasingly valuing sustainability – from ethically made apparel to organic food. The crystal industry is being forced to address similar concerns. As noted, there’s rising demand for ethically sourced crystals, which is pushing retailers to verify their supply chains. Some crystal sellers now explicitly state the origin of each stone and any ethical sourcing claims (e.g. “mined by a family-owned mine in Peru with fair wages”). There is also a budding movement to create some kind of certification or standards in the crystal trade, akin to “conflict-free diamonds” or “Fair Trade” for coffee, though nothing universally adopted yet. On the environmental side, many crystals are non-renewable mined resources, and mining can cause habitat damage – issues that clash with the wellness ethos. Progressive retailers are trying to mitigate this by supporting reclamation projects or partnering with organizations that give back to mining communities. Packaging is another area: like broader retail, crystal shops are moving toward eco-friendly packaging (using biodegradable peanuts, recycling materials, minimal plastic) to align with consumer expectations. While the industry has work to do to reach the transparency levels of, say, the farm-to-table food industry, the pressure from consumers mirrors the general sustainability push in retail. This is one area of potential contrast too: some parts of the crystal supply chain remain quite opaque and old-school (deals done at gem shows in cash, stones changing many hands, little documentation). Compared to a product like organic skincare, which might advertise supply chain traceability, crystals have lagged – but this gap is starting to close as more buyers ask tough questions.

-

Personalization & Curation: A big trend in retail is personalization – giving customers products or recommendations tailored to their preferences. The crystal market embraces this wholeheartedly. Products are inherently personal (people choose stones that “call” to them or that match an intention). Retailers have leaned into curated sets (e.g. a “sleep kit” with amethyst, howlite, and a lavender spray) and guided shopping experiences (some websites let you shop by intention or by zodiac sign, essentially filtering the catalog to personalize it). This is akin to how mainstream beauty retailers might offer personalized skincare regimens or fashion retailers use quizzes to suggest clothing. Moreover, the subscription boxes and surveys (like Crystal Council’s model) are a direct application of personalization in retail, very much on trend with the broader subscription box craze. One unique aspect with crystals is the idea of intuitive selection – some sellers offer to meditate and pick a crystal “meant for you.” While not conventional personalization driven by data, it speaks to the same desire for bespoke service and resonates with the spiritual audience.

-

Retail Innovation & Trends: The crystal industry is even seeing experimental retail formats, much like mainstream retail’s pop-ups and concept stores. For example, there are pop-up crystal installations at yoga festivals or wellness conventions. Some sellers are trying mobile retail (selling out of converted vans at festivals or farmers markets, bringing crystals to events). This flexibility is similar to food trucks or fashion pop-ups – meeting customers in new environments. On the digital front, a few crystal retailers are early adopters of trends like live commerce (as discussed) which is also being tested by larger retailers (e.g. beauty brands hosting live shopping events). Another interesting parallel is storytelling in marketing: just as a winery might tell the story of a wine’s terroir, crystal sellers often tell the story of a stone’s journey (“This amethyst was formed 100 million years ago in the volcanic soils of Brazil’s Minas Gerais and was hand-dug by cooperatives…”). Storytelling is a powerful retail trend to create product value beyond functionality, and in crystals, it comes quite naturally.

In summary, the crystal market aligns with many contemporary retail practices – omnichannel sales, experiential engagement, sustainability efforts, personalization – but it also retains a distinctive grassroots character. The industry’s challenges (like supply chain opacity) highlight where it diverges from the polished operations of mainstream retail, yet the gap is narrowing as the sector grows up. Notably, one contrast is that big-box or mass retail hasn’t fully taken over this niche; whereas many industries see domination by giant corporations, the crystal market remains dominated by small to mid-sized businesses and community sellers. This fragmentation is more reminiscent of the early days of natural/organic products before they were acquired by conglomerates. Time will tell if the crystal trade consolidates or remains an ecosystem of independents, but for now its structure is somewhat alternative compared to typical retail, even as it embraces modern tactics.

Actionable Takeaways for Crystal Retailers

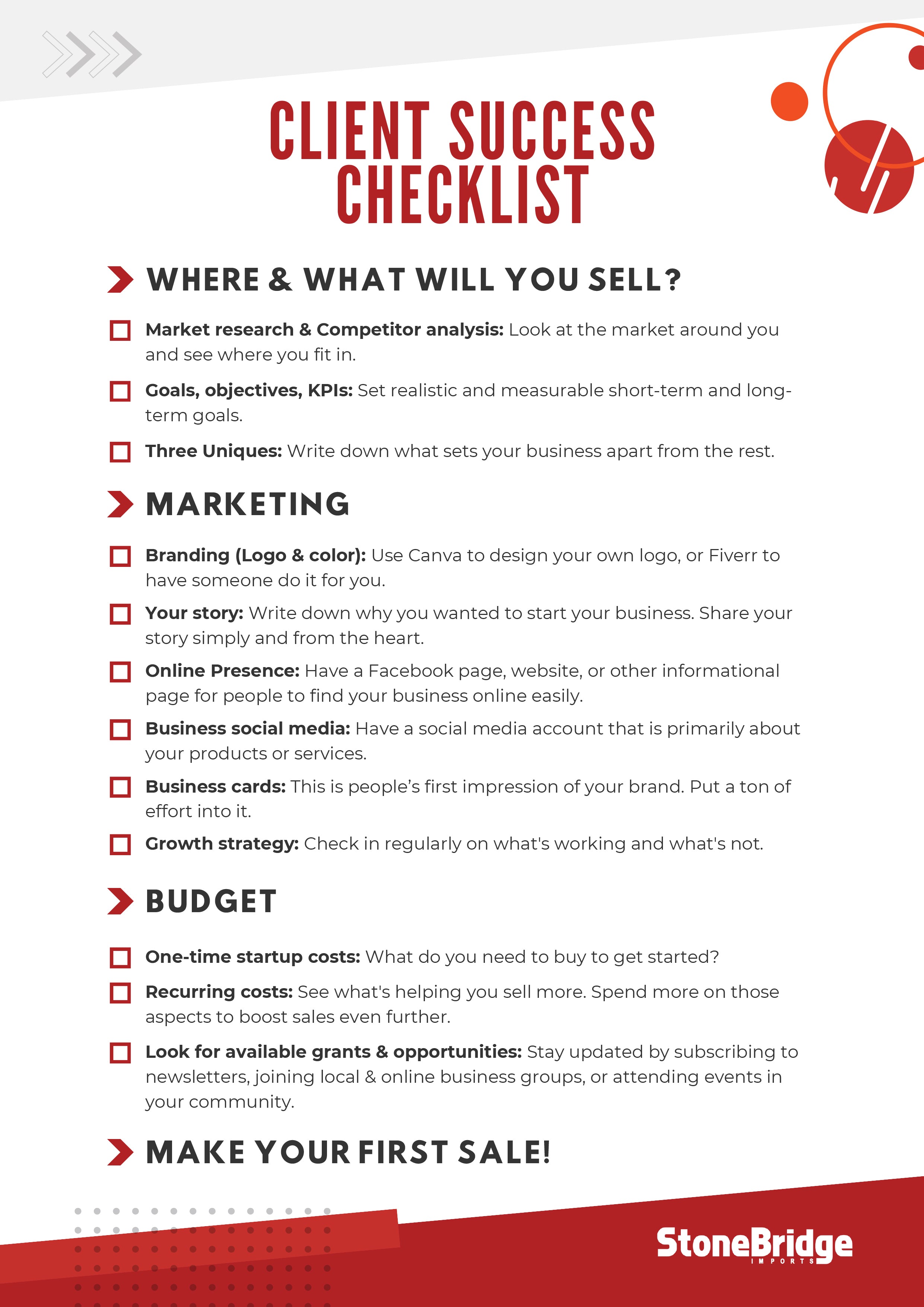

For crystal sellers looking to stay ahead in this evolving market, here are some strategic insights and recommendations:

-

Embrace Omnichannel Selling: To reach today’s customers, be present across multiple channels. This means not relying solely on a physical storefront or a single platform. Consider maintaining both an e-commerce site and a presence on popular marketplaces like Etsy or Amazon to expand your reach. Use social media not just for marketing but as a sales channel (Instagram Shop, Facebook Shop). Ensure your branding and customer experience are consistent across all touchpoints. For instance, a customer who discovers you on Instagram should find it easy to navigate to your website or visit your booth at a local market. An omnichannel approach can also hedge against policy changes or fee increases on any one platform. As an example, Sage Goddess built its own site but also sells on Etsy to capture that audience (10 Best Online Shops For Healing Crystals - The Good Trade). Diversifying channels provides resilience and amplifies visibility.

-

Leverage Social Media & Content Marketing: Given the huge influence of social media on this market, invest time in building a strong online community. Share informative and inspiring content: crystal care tips, healing guides, origin stories of stones, or behind-the-scenes looks at your sourcing. Engage with trends (e.g. post a TikTok video when a certain stone is trending). Use high-quality visuals – crystals are inherently photogenic, so let them shine with good lighting and creative staging. Collaborate with influencers or micro-influencers in the wellness and spirituality space; a single shoutout or demonstration of your product to their followers can drive significant traffic. Also consider hosting live sales or Q&A sessions on Instagram/Facebook – these not only generate immediate sales but also let you interact directly with customers, building trust. The key is consistency and authenticity: post regularly and respond to comments to cultivate loyalty. Over time, a passionate follower base becomes your best marketing asset through word-of-mouth and user-generated content.

-

Differentiate with Education and Expertise: Since consumers value knowledge in this arena, position your brand as a trusted expert. Provide accurate information about your crystals’ properties, and be honest about what’s lore versus proven (managing expectations). You might offer workshops or webinars on topics like “Crystal Healing 101” or “How to Meditate with Crystals” – either free as a community service (attracting potential customers) or as a low-cost class (an additional revenue stream). Some retailers have even published books or extensive blogs that establish them as authorities. If you have credentials (e.g., you’re a certified healer, gemologist, or have direct experience with mines), highlight that in your story. Customers are more likely to buy from someone who clearly loves and understands the products. Additionally, providing guidance in-store or via chat online helps consumers choose the right crystal for their needs, enhancing the shopping experience. In essence, think of yourself not just as a seller of rocks, but as a guide helping people through their wellness or collecting journey.

-

Prioritize Ethical Sourcing & Transparency: As awareness grows, make ethical sourcing a cornerstone of your brand. Whenever possible, source from suppliers who adhere to fair labor practices or from mines with safe conditions. Get to know your upstream sources – attend gem shows to meet miners, ask tough questions, perhaps even visit mining areas if feasible. Then, pass that transparency to your customers: share the origin of each stone (country, region, or even specific mine/co-op). If certain stones in your inventory are lab-grown or treated (which is okay for some uses), label them as such – honesty builds trust. You can also implement give-back initiatives, like donating a portion of profits to environmental restoration or to communities in mining regions. These actions not only appeal to ethically minded consumers but can also become part of your brand story (e.g. “We only sell conflict-free crystals” or “All our malachite is sourced directly from a community-owned mine in the Congo, supporting local families”). In a market where not all competitors will make this effort, sustainability can be a key differentiator and future-proof your business as regulations or consumer pressures increase.

-

Innovate in Product Offerings: Stay agile and creative with what you offer. The crystal market is dynamic – new finds and trends emerge regularly. Keep an eye on trending stones (for example, if lapis lazuli home decor or shungite for EMF protection becomes a buzz, consider stocking it). However, be cautious of fleeting fads; balance inventory so you’re not over-leveraged on one trend. Expand your product lines thoughtfully: can you create bundles or kits that add value? (e.g., a “Chakra Balancing Set” with seven stones, or a kit that pairs a crystal with a guided meditation audio download). Explore related categories: crystal-infused products like candles, essential oil rollers with crystal chips, water bottles with crystal inserts, or even crystal-themed home goods (coasters, lamps) are popular and allow upselling. Also consider personalized products, like custom wire-wrapped jewelry or intention jars filled with specific stones – these cater to the personalization trend. By refreshing your inventory and offerings, you encourage repeat purchases from existing customers and attract new segments (maybe someone who isn’t into crystal healing would still buy a stylish agate cheese board, for example).

-

Enhance Customer Experience & Trust: Whether online or offline, focus on providing an excellent customer experience. For online shops, that means clear photographs (multiple angles, true color), accurate descriptions (include dimensions, weight, and note if it’s natural or treated), and reasonable shipping rates with secure packaging (nothing disappoints a customer more than receiving a broken crystal due to poor packing). Consider offering a satisfaction guarantee or easy returns, which reduces the risk for first-time buyers. Encourage customers to leave reviews or testimonials to build social proof. If you do live sales, manage them professionally – track claims, invoice promptly, and ship on time. For physical retail, create an inviting atmosphere: categorize stones in intuitive ways (by color, by intention), provide reference charts or books for people to browse, and train staff to be friendly and knowledgeable without being pushy. Little touches like a small info card given with each purchase (“Your Amethyst – known as a stone of peace and intuition…”) can delight customers and reinforce the value of their purchase. Trust is currency in this market: because crystals’ value is partly intangible, customers need to trust the seller (that the stone is real, and that it’s the “right” one for them). Building that trust through authenticity, consistency, and great service will lead to repeat business and positive word-of-mouth.

-

Build a Community & Engage Your Customers: Don’t just focus on transactions; focus on relationships. Engage your customer base beyond the sale. Social media groups, as mentioned, are a great way to do this – perhaps start a Facebook group for people who bought from you to share how they use their crystals, or an Instagram hashtag for your brand’s community. Host events (virtual meditations, in-person meetups if local) to bring customers together. Some retailers have started loyalty programs or membership clubs (e.g. pay a small fee to get perks like a monthly discount, early access to new arrivals, or a free stone on your birthday). These initiatives make customers feel valued and part of something special, which in turn increases retention. Engaged customers are also more forgiving if issues arise (like a shipment delay) because they see the human side of your business. Storytelling can reinforce community – share customer stories or feature “collector spotlights” showcasing a patron’s collection. When people feel emotionally connected – that your brand gets them and shares their values – they are likely to stick with you even if competitors offer slightly lower prices. In an evolving market, a loyal community is one of the strongest moats you can build.

-

Stay Informed & Adaptable: Finally, keep learning and stay adaptable. The market for crystals is tied to larger trends in wellness, fashion, and even geopolitics (trade regulations, mining outputs, etc.). Subscribe to industry newsletters, follow global gem show reports, and listen to customer feedback closely. If a particular source dries up or becomes problematic ethically, be ready to pivot to alternatives. Keep an eye on what big players are doing (e.g., if a major retailer like Urban Outfitters starts a crystal line, how might that affect niche sellers? Perhaps by raising general awareness). Also monitor the regulatory environment; as crystals become more popular, there could be increased scrutiny (for example, consumer protection agencies might crack down on false healing claims, or import/export rules might change). Being proactive – such as diversifying suppliers or adjusting marketing language to be responsible – will help you avoid pitfalls. In short, treat your crystal business with the same seriousness as any other retail venture: use data, watch trends, listen to your customers, and be willing to refine your strategy. The core appeal of crystals isn’t likely to disappear (they have millennia of history on their side, after all), but how people shop for and use them will evolve with the times. Sellers who evolve with those changes will thrive.

By focusing on these strategies, crystal retailers can strengthen their position and continue to grow alongside the booming interest in collector minerals and healing stones. The market’s future in North America looks bright – sustained by a cultural gravitation toward wellness and spirituality – but also demands agility and integrity from those who participate in it. Businesses that combine innovative retail tactics with the timeless allure of crystals, all while keeping the customer’s trust at the forefront, will be well-equipped to succeed in this enchanting and ever-evolving market.

Sources:

- Market size and growth figures for the U.S. crystal market (Healing Crystal Industry Forecast for 2024 in the USA - Wishcrystal.com) (Healing Crystal Industry Forecast for 2024 in the USA - Wishcrystal.com); global spiritual/wellness products market growth (Spiritual and Wellness Products Market Poised to Reach US$).

- Analysis of cultural acceptance (42% Americans and New Age beliefs) (Why Crystals And Gemstones Are Taking The Center Stage In Jewelry And Accessories); social media trends on TikTok (Healing crystals work (if you choose to believe in them) – The Wildcat Tribune).

- Industry trend insights on technology integration (Forecast for Healing Crystal industry in 2025 - Wishcrystal.com), sustainability priorities (Forecast for Healing Crystal industry in 2025 - Wishcrystal.com), and crystals in home décor (Forecast for Healing Crystal industry in 2025 - Wishcrystal.com).

- Media reporting on ethical issues in crystal mining (Guardian) (Dark crystals: the brutal reality behind a booming wellness craze).

- Distribution channel breakdown – online vs. physical – from industry reports (Healing Crystal Industry Forecast for 2024 in the USA - Wishcrystal.com) (Healing Crystal Industry Forecast for 2024 in the USA - Wishcrystal.com).

- Examples of major players and their differentiators: House of Intuition sourcing model (10 Best Online Shops For Healing Crystals - The Good Trade); Sage Goddess scale and services (10 Best Online Shops For Healing Crystals - The Good Trade) (10 Best Online Shops For Healing Crystals - The Good Trade).

- Wholesale market dynamics: WishCrystal supplying 3000+ North American retailers (Crystal Wholesaler and Manufacturer of Metaphysical Crystals in United States & Canada.).

- Role of gem shows: Tucson showcase scale (First-Timer's Guide to the World's Largest Gem Show | Visit Arizona) and international vendor presence (First-Timer's Guide to the World's Largest Gem Show | Visit Arizona).

- Social selling and live sales practices ( 5 Best Places to Buy Wholesale Crystals In Bulk ).

- Subscription box popularity (Crystal Council) (Monthly Crystal Subscription Box | The Crystal Council - The Crystal Council ) (Monthly Crystal Subscription Box | The Crystal Council - The Crystal Council ).

- Pew Research data on New Age beliefs (via Bauce Media/Pew) (Why Crystals And Gemstones Are Taking The Center Stage In Jewelry And Accessories).

- Additional context from industry articles and expert blogs as cited throughout.